- Firm

- Team

- Practice Areas

- Corporate / Commercial

- Employment / Labour

- Family Law / Personal Status

- Real Estate / Property Investment

- Dispute Resolution / Litigation

- Criminal / Penal

- Company Formations

- U.A.E. Immigration

- Administrative / Pro Services

- Intellectual Property

- Media / Communication

- Wills / Inheritance

- Aviation / Aircrafts

- Cryptocurrency / Virtual Assets

- Financial Restructuring / Insolvency

- U.A.E Tax Laws / Regulations

- Podcast

- Blogs

- Contact Us

- Search

DMCC Dubai Introduces WPS

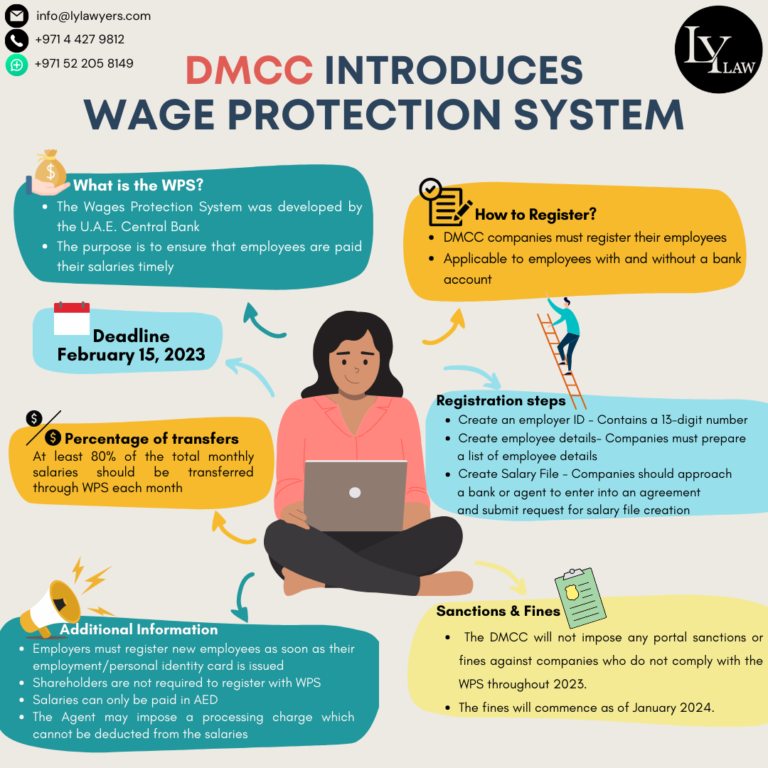

On January 18, 2023, the DMCC Dubai announced that it would be implementing the U.A.E. Wages Protection System (WPS), for employee salary payments.

DMCC Dubai – Wage Protection System U.A.E. | Guidelines

1. Deadline to Register

The deadline for employers to register their employees with the s U.A.E. Wages Protection System is February 15, 2023.

2. What is the U.A.E. WPS?

The U.A.E. Wages Protection System was developed by the U.A.E. Central Bank. The purpose of the system is to ensure that employees are paid their salaries timely, and in line with their employment contracts.

3. How to Register?

DMCC companies must register their employees through the system. This is for employees both with and without a bank account in the U.A.E. Below are the relevant registration steps.

i. Create an employer ID: The employer ID is a 13-digit number, consisting of the following structure – DMCC + 0000 + company’s portal account number.

ii. List of employee details (employees with bank accounts): The company should prepare a list of all its employees’ details. The list should include: 1) employee name, 2) employee ID, 3) routing code, 4) account number, and 5) IBAN number.

§ Employee IDs: The employee ID for employees with a bank account consists of the following structure – DMCC + 000 + employment card/personal identity card number.

iii. List of employee details (employees without bank accounts): For employees who do not have a bank account, the list of their details will only include their name and employee ID number.

iv. Salary File Creation: Once the above requirements are prepared, companies should then approach a bank or exchange house (Agent). The company will enter into an agreement with the Agent. And, submit a request to create a salary file for its employees.

DMCC Dubai – Wage Protection System U.A.E. | Additional Information

Sanctions & Fines:

Throughout 2023, the DMCC Dubai will not impose any portal sanctions or fines against companies who do not comply with the WPS. The fines will commence as of January 2024.

New Employees:

Employers within the DMCC Dubai must register new employees with U.A.E. WPS as soon as their employment/personal identity card is issued.

Shareholders:

Shareholders are not required to register with the U.A.E WPS.

Currency:

Salaries can only be paid in AED.

Processing Charges:

The Agent may impose a processing charge for requests through U.A.E. WPS. These cannot be deducted from the salaries of employees.

Percentage of Transfers:

As per Ministerial Resolution No. 788 of 2009, on Wage Protection, at least eighty percent (80%) of the total monthly salaries should be transferred through U.A.E. WPS each month.

Wage Protection System U.A.E. | How

are Salaries Transferred?

The general structure for U.A.E. WPS

salary transfers are as follows:

Salary

Information File

The company should send the Agent a salary information file (“SIF”).

This is generally in the form of an excel sheet, with a particular structure

and format.

§ Employee

Details: The excel sheet should include the following details

for each employee: 1) 13-digit employee ID, 2) 9-digit

routing code ID of the employee, 3) employee’s IBAN number, 4) pay start date,

4) pay end date, 5) number of days for which salary is being paid, 6) fixed

income amount, 7) variable income amount (overtime, bonus, etc.), and 8) day on

leave for the period (without pay).

§ Employer

Details: In addition, the excel sheet should include a final

row, with the following details of the employer: 1)

employer ID number, 2) 9-digit bank code, 3) file creation date, 4) file

creation time, 5) salary month, 6) total number of employees, 7) total salary

amount, and 8) payment currency (always AED).

SIF to Agent

The employer should then send the salary information file to the Agent.

Agent to Central Bank

The Agent, through the U.A.E. WPS, will send the details and salary transfer

instructions to the Central Bank electronically.

Central Bank to MOHRE/DMCC Dubai

Generally, at this stage, the Central Bank would forward this database to

MOHRE, to confirm that the details are accurate and in line with the employees’

contracts. However, in this case, the details may instead be transferred

to the DMCC Dubai.

WPS to Agent

Through the U.A.E. WPS, the Agent will receive authorization to release the

payments to the employees accordingly.

DMCC Dubai & WPS U.A.E - FAQs

The U.A.E. Wages Protection System was implemented by the U.A.E. Central Bank. The purpose is to ensure that employees get their salaried paid timely – in line with their employment contracts.

February 15th 2023, is the deadline given for DMCC companies to register their employees with the WPS.

The Dubai DMCC will not impose any portal sanctions or fines throughout 2023. However, the fines will commence as of January 2024.

Yes, as per Ministerial Resolution No. 788 of 2009, on Wage Protection, at least 80% of the total monthly salaries should be transferred through U.A.E. WPS each month.

The Wage Protection System, as is relevant to U.A.E. Domestic Workers, does not apply to all categories of domestic workers. It excludes categories such as housekeepers, nannies, and gardeners. Specifically, it is only applicable to the following five (5) categories:

- Private agricultural engineers;

- Private tutors;

- Personal Trainers;

- Home nurses;

- Personal Assistants.