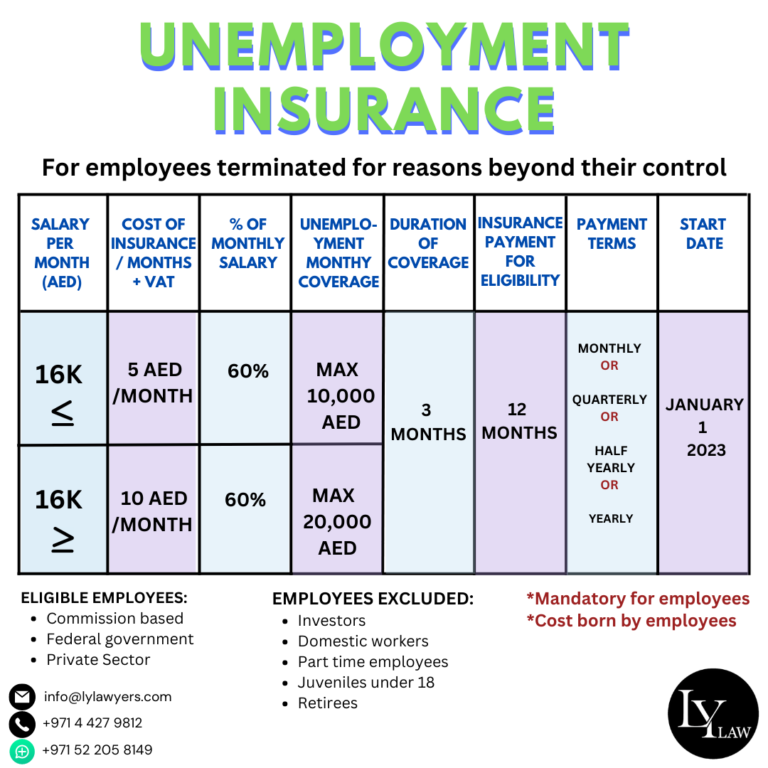

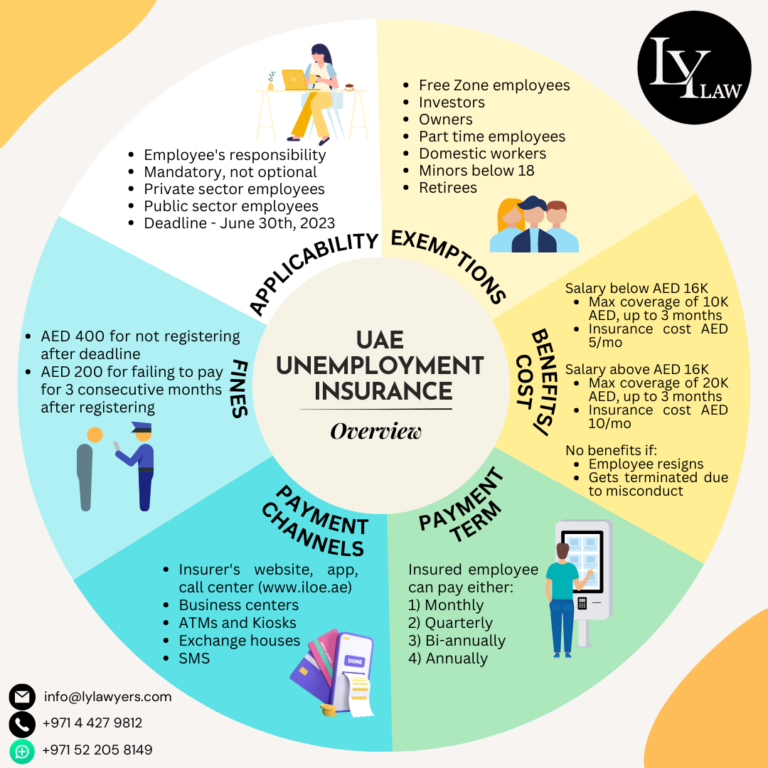

The UAE Unemployment Insurance Scheme is a new decision issued by the UAE Ministry of Human Resources and has come into effect in January 2023. Presently the Dubai Insurance Company is appointed as the provider of the Unemployment Insurance Scheme. It is mandatory for employees, both residents and nationals.

UAE Unemployment Insurance – Subscription

The UAE Unemployment Insurance Scheme has two categories. The employee can subscribe and pay the fee based on the monthly salary.

Unemployment Insurance Category 1 – Subscription payment of AED 5.00 if the basic salary is less than AED 16,000.00.

Unemployment Insurance Category 2 – Subscription payment of AED 10.00 if the basic salary is more than AED 16,000.00.

UAE Unemployment Insurance Scheme – How to Apply

Employees may subscribe for the Unemployment Insurance Scheme though the ILOE Insurance Pool website, through its app or any other channel that the MoHRE will announce in the upcoming months.

Note – The Unemployment Insurance UAE is a mandatory requirement for the employee and the employers.

UAE Unemployment Insurance Scheme – Fee Payment

Once the employee has registered, the subscription fee can be paid through the following methods:

- The insurer’s mobile application;

- The insurer’s call center;

- Ministry approved business centers;

- ATMs and Kiosks as set by the insurer, and in coordination with MOHRE;

- Exchange houses;

- SMS.

UAE Unemployment Insurance Scheme – Payment

The insured employee can choose to pay either monthly; quarterly; bi-annually; or annually. If the employee does not pay based on the selected plan for more than three months from the due date, the insurance policy will be considered as terminated. Moreover, a financial penalty shall be imposed.

UAE Unemployment Insurance Scheme – How to Claim Benefits

- To receive the Unemployment Insurance benefits, an employee must submit his claim for coverage within 30 days from the termination of the employment relationship.

- The compensation due to the employee shall be 60% of the basic salary. It is calculated based on the average for the previous 6 months. And, the compensation amount shall not exceed 3 months’ salary.

- The insurance provider must pay the compensation amount within no more than 2 weeks of the applicant submitting all the necessary documents.

UAE Unemployment Insurance Scheme – Fines & Suspensions

- Non-Subscription. An employee who does not subscribe to the UAE Unemployment Insurance is liable to pay AED 400.00 after the registration period ends (June 30, 2023).

- Non-Payment of Subscription. If an employee subscribes to the UAE Unemployment Insurance, and does not pay within 3 months of the due date, a penalty of AED 200.00 will be imposed.

- Non-Payment of Penalty. If the fine is not paid within 3 months of when it is due, the charged amount will be deducted from the employee’s salary through the Wage Protection System, or from their end of service, or any other process that the MOHRE decides.

- Work Permit Suspension. MOHRE will suspend issuance of any new work permits for an employee who has not paid the penalties imposed for non-subscription or non-payment of the UAE Unemployment Insurance Scheme.

UAE Unemployment Insurance – Exempted Employees

The following are the list of employee categories who are currently exempted from applying for the Unemployment Insurance Scheme in the UAE.

- Free Zone employees.

- Investors (such as owners of firms in which they work),

- Domestic workers

- Part-time workers,

- Workers below 18 years old,

- Retirees who receive a pension and have joined a new job.

UAE Unemployment Insurance – Grace Period for Employees

The deadline employees have to register for the Unemployment Insurance is until June 30, 2023 following which, penalties will be imposed. For employees who have been employed after January 1, 2023, must register within 4 months from:

- When they entered the UAE with the employment entry permit; OR

- From the change of status; OR

- The final approval of the work permit issuance for employees who do not need a change of status.