Ramadan UAE - Overview

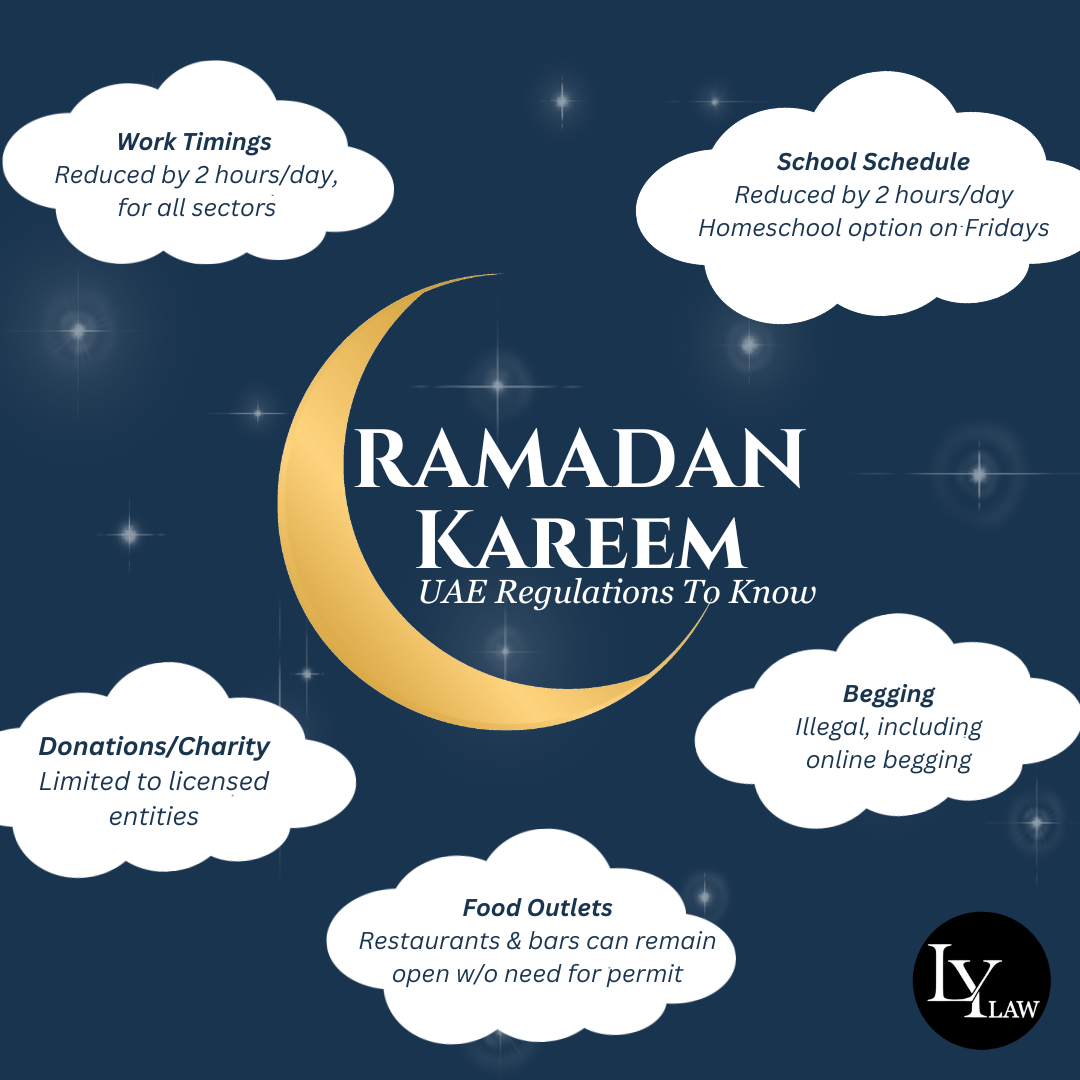

UAE Ramadan – Working Hours

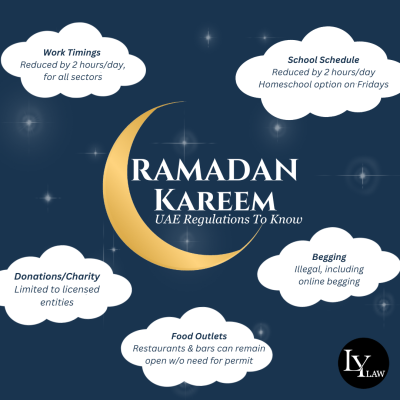

The UAE Ramadan working hours must be reduced by 2 hours a day.

This applies, equally, to the: 1) private sector, 2) public sector and 3) schools.

And for everyone – those who fast, as well as those who do not.

The requirement to reduce working hours during Ramadan in UAE for the private sector is set out in Article 15(2) of the Cabinet Decision No. 1 of 2022 re: Implementing Regulations of the UAE Labor Law.

Furthermore, with regards to the public sector, on Fridays, federal employees will work remotely – 70% of their working hours.

Similarly, schools in the UAE have the option of allowing students and staff to attend school from home on Fridays, during the whole month of Ramadan.

UAE Ramadan – Dubai Restaurants & Outdoor Dining

Ramadan, as we all know, is a month of fasting for Muslims.

And the UAE observes and encourages a fasting-friendly environment.

As such, for the non-fasting population, it is sensible to avoid eating or drinking publicly, out of respect for those who are fasting.

Over the recent years, the UAE, as an increasingly multicultural society, has relaxed many of its previously stringent Ramadan protocols.

In Dubai, in 2021, the Department of Economic Development issued a Circular, stating that:

- Food outlets were no longer required to serve food out of public view, during fasting hours.

- And that screens and curtains, particularly, in malls, would no longer be required.

- Nor would the Dubai restaurants be required to obtain a permit for serving food during fasting hours.

This Circular replaced previous circulars, which had required restaurants to block dining areas from the sight of those who were fasting. As such, as we enter Ramadan 2023, in Dubai:

- Dubai Restaurants, cafes and bars can remain open and serve food publicly.

- Supermarkets, pharmacies, malls and businesses can also remain open throughout the day.

- Though live music will most likely be less popular during this time.

@ludmilayamalova Working Hours During Ramadan #Ramadan2023 #RamadanKareem #Ramadan #ramadanmubarak #trending ♬ Ramadan Kareem - user6324458296283

@ludmilayamalova UAE Food Outlet Guidelines for Ramadan #ramadan2023 #ramadanmubarak #trending #restaurant ♬ TWINNEM - Coi Leray

UAE Ramadan – Anti-Begging Law

While honoring the spirit of giving and sharing, during the holy month of Ramadan in the UAE, remember not to do so through begging, or encourage begging. This is because any form of begging in the UAE is illegal.

There is a specific law on Anti-Begging, which is the UAE Federal Decree Law No. 31 of 2021.

- Pursuant to which, anyone who is caught begging in the UAE will be subject to: 1) a fine of AED 5,000 and 2) imprisonment of up to 3 months.

- Furthermore, any type of organized begging is subject to even stricter 1) fine of AED 100,000, and 2) a 6-month imprisonment.

- Also, begging using online or digital means is subject to a separate law, which is the UAE Cybercrime Law, No. 34 of 2021. And Article 51 of that law, in particular, titled Cyber Begging.

- Which criminalizes online begging, with 1) a minimum fine of AED 10,000 and/or 2) imprisonment for up to 3 months.

Importantly, the UAE Cybercrime Law also penalizes anyone who, through digital means, enables unauthorized raising or collection of funds.

UAE Ramadan – Donations Law

During this holy month of Ramadan, when the spirit of sharing and giving, in the Muslim communities, is at its highest, it is important to remember that there are specific laws, regulating donations and charitable activities in the UAE.

- In other words, any type of 1) donations, 2) fundraising or 3) other charitable efforts can only be conducted by properly licensed and authorized organizations.

- Unauthorized 1) collection of donations or 2) use of donations can lead to serious penalties, including: 1) imprisonment and 2) a fine from AED 150,000 – 500,000, depending on the offense.

- Importantly, this applies not only to collecting donations without a proper license, but also sending or transferring unauthorized donations.

- There is also a separate fine of AED 100,000 for any unlicensed entity, which claims to be a charitable or humanitarian organization.

This is governed by the UAE Federal Law No. 3 of 2021 on Regulation of Donations.

However, if you wish to donate or contribute, some examples of licensed organizations in the UAE are:

- Emirates Red Crescent Authority

- Khlaifa Bin Zayed Al Nahyan Foundation

- Al Maktoum Foundation

- Emirates Charity Portal

- Dubai Cares, among others…

So, if you want to give or share, there are many meaningful opportunities to do so legally.

@ludmilayamalova Ramadan - Anti-Begging Law UAE #ramadan2023 #ramadanspirit #trending #begging ♬ Believe Me - Navos

@ludmilayamalova Donations During Ramadan #ramadan2023 #ramadanmubarak #donations #charity #trending ♬ Life Goes On - Oliver Tree

UAE Ramadan Overview - FAQs

The UAE Ramadan working hours have been reduced by 2 hours a day.

No. The reduced working hours during Ramadan in UAE is applicable equally to both fasting and non-fasting employees across private sectors, private sectors and even schools.

Yes. It is mandatory for companies to abide by UAE Ramadan working hours and it is applicable to both fasting and non-fasting employees.

Yes, however, only through licensed and authorized entities in the UAE. Here are some examples of licensed organizations if you wish you donate this Ramadan.

- Emirates Red Crescent Authority

- Khlaifa Bin Zayed Al Nahyan Foundation

- Al Maktoum Foundation

- Emirates Charity Portal

- Dubai Cares

Yes. As per the Circular issued by the Department of Economic Development in 2021:

- Food outlets such as cafes and restaurants in Dubai can remain open and serve food publicly.

- Even supermarkets, malls, pharmacies and businesses can also remain open throughout the day.

Live music will most likely be less popular during Ramadan in UAE. As such, for the non-fasting population, it is sensible to avoid eating or drinking publicly, out of respect for those who are fasting.